US Stock Market Crash: Nearly Trillion-Dollar Losses Rock Markets Amid Unprecedented Volatility

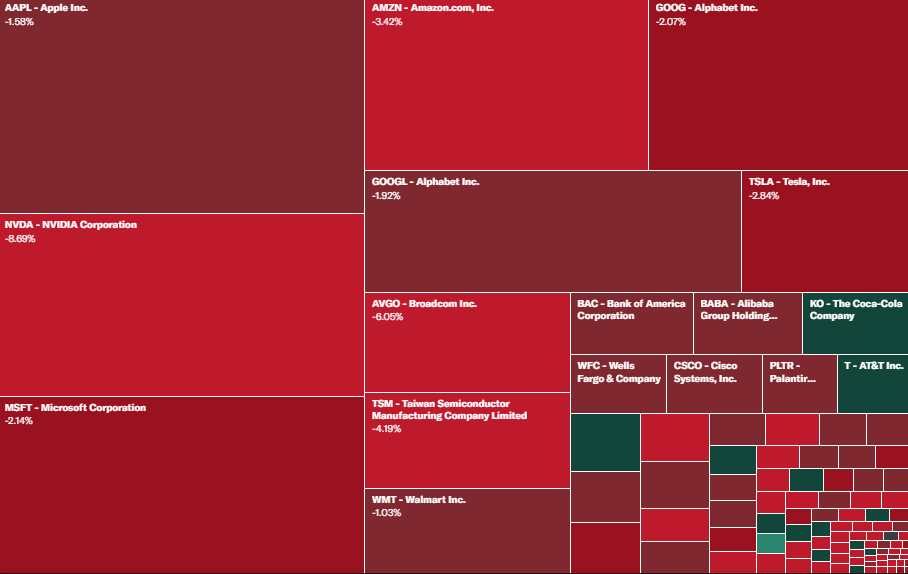

The US stock market has experienced a historic downturn over the past few days, with nearly a trillion dollars in market value evaporating in a single crash. This unprecedented event has rattled investors and financial experts alike, prompting urgent discussions about the causes and implications for the broader economy.

Overview of the Historic Market Crash

In recent trading sessions, major stock indexes plunged dramatically, recording losses that amount to nearly a trillion dollars. The intensity of this crash has not only shaken market confidence but also raised critical questions about systemic vulnerabilities in the financial system.

Key Contributing Factors

Several factors have converged to trigger this severe market downturn, including:

- Weakening economic data coupled with rising inflation expectations

- Geopolitical tensions and global economic uncertainties

- Rapid changes in monetary policy and aggressive interest rate hikes

- Investor panic leading to widespread sell-offs in blue-chip stocks

Impact on Investors and the Economy

This massive decline in market value has had immediate repercussions for investors, with many witnessing significant portfolio losses. Financial institutions are now closely monitoring liquidity and risk levels, while policymakers debate interventions to stabilize the market.

Expert Analysis and Future Outlook

Experts remain divided on the long-term effects of this crash. While some warn that the damage could signal the onset of a broader recession, others suggest that the downturn may be a corrective phase, paving the way for a more sustainable recovery in the coming months.

Investor Guidance in Turbulent Times

For those caught in the turmoil, experts recommend maintaining a long-term perspective. Diversification, dollar-cost averaging, and staying well-informed are key strategies to help navigate such volatile market conditions.

Conclusion

This nearly trillion-dollar market crash is a stark reminder of the inherent risks in the financial markets. As investors and institutions work to assess the full impact, continuous updates and expert insights will be crucial for understanding the evolving situation. Stay tuned for further analysis as this historic event unfolds.